Featured Story

Our House D.C. Podcast

Videos

Secretary Marcia L. Fudge on the Importance of Housing Counseling

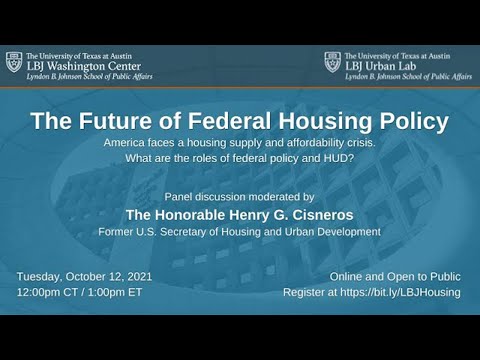

The Future of Federal Housing Policy

A Conversation with Austin R. Cooper, Jr., Managing Editor, Our House D.C.

Manna House and Neighbor Works America